How to boost online sales this holiday season with a personalized shopping experience

The holiday season is the most crucial period for retailers. Besides high sales volume, it is also an opportunity to…

Read more25. 06. 2024.

As you probably already know, the sales funnel plays a critical role in guiding potential customers from initial awareness to final conversion.

However, its role isn’t just about pushing products — it’s about understanding and meeting customer needs at every stage. From the first interaction to the final decision, each step must be carefully managed to ensure a seamless and satisfying customer journey.

With banks striving to better understand their customers and provide personalized experiences, embracing advanced technologies has become a must.

This is where recommender systems come into play, helping banks change the way they interact with their customers, offering tailored suggestions that enhance the customer experience, and drive conversions.

In this blog post, we’ll help you better understand how recommenders in banking sales funnel work and explore the best ways to improve it.

Stay put and keep reading!

Table of Contents

You’ve been told that banks should use recommenders because they can help you significantly improve customer satisfaction and sales.

How is that possible?

Well, these systems can analyze the data you have to suggest products and services that fit your clients’ needs and interests. This means that using recommenders in banking allows you to create a more personalized approach that makes customers feel understood and valued. This is important because it helps build trust and loyalty, too.

Moreover, if you’re trying to boost your revenue, recommenders can help you identify new opportunities for cross-selling and up-selling. Sometimes, you must step up with relevant and timely offer suggestions and that’s precisely what recommenders can help you give to your customers.

Now, to stay competitive in the crowded banking landscape and still be able to provide exceptional customer experience, it’s paramount that you understand the banking sales funnel.

Beyond that, you should know what each stage represents and how you can help your customers move from one stage to the other until they reach the goal — the final stage.

Read on as we discuss each stage separately and explore potential challenges you can encounter during every stage:

In most cases, the banking sales funnel begins with the awareness stage.

At this point, potential customers first learn about your bank and the services you have to offer. So, what is your goal during the awareness stage?

To make a memorable first impression that piques the interest of your potential customers.

It all sounds so easy, right? However, you might encounter some challenges even during this initial stage of the banking sales funnel.

Usually, one of the main challenges in the awareness stage is capturing your customers’ attention in a market filled with numerous competitors. This is why you need effective marketing strategies to stand out — advertising, social media, or community engagement.

Next is the interest stage, where potential customers start exploring your offers more closely. During this stage, they might visit your website, read about your products online, or ask for recommendations.

The interest stage is important for grabbing and retaining the attention of your future clients. The biggest challenge here is providing relevant and engaging information that holds their attention.

Clearly communicating the benefits of your offer and services is key here, especially if you’re eager to meet your customers’ needs. Investing in effective content marketing and user-friendly online resources can make a big difference in this stage.

The consideration stage follows, where your potential customers explore and evaluate their options by comparing different banks and offers. This stage is crucial as it involves convincing prospects that your products or services are the best fit for them.

But how can you convince them that your bank is the best choice among many options?

By highlighting your unique selling points, building trust and differentiating your bank from competitors.

In the decision stage, potential customers are ready to choose their bank. However, they still may be unsure and hesitate to make a final decision.

During this stage, your biggest challenge is to address their hesitations and concerns, as well as to make the final step as easy and appealing as possible. Even if they are close to making a decision, any uncertainty can make them reconsider.

A few smart moves at this point may be:

Finally, the loyalty stage comes as a cherry on top where your focus is completely on maintaining a strong relationship with the customers who have chosen your bank.

Once they choose your bank, you need to keep meeting, and exceeding even, their expectations to retain their loyalty and maintain their satisfaction in the long term.

At this stage, you should keep providing consistent, high-quality service, and personalized experiences, and maintain regular communication so that your customers feel valued and understood.

Loyalty programs, regular communication, and excellent customer service are key to your customer retention and long-term loyalty.

Using recommenders in banking sales funnel can have a truly transformative effect. They can help you provide more personalized and relevant suggestions at each stage of the customer journey.

Let’s see how you can use them.

In the awareness stage, you don’t really have a lot of data to personalize your offers. But all is not lost.

At this stage, recommender systems can work with demographic and behavioral data. Thanks to this data, recommenders can introduce potential customers to personalized offers.

For example, Solver AI Suite can identify and target individuals with customized promotions, ensuring that the initial contact is both relevant and engaging. This helps capture attention in a crowded market, making you stand out with tailored marketing efforts.

Moving to the interest stage, recommenders can help you improve customer engagement by offering history-based recommendations. How does this work?

In the banking sales funnel, recommenders analyze historical transactions of your clients. This allows them to predict what other services they might respond well to or suggest products or services that they are likely to need soon.

Let’s say you have a customer who has consistently maintained a high balance in their checking account. By analyzing their historical transactions, recommenders in banking can identify this pattern and suggest a new savings account with a higher interest rate that better suits their financial behavior.

This proactive approach shows them two important things:

If you keep offering tailored financial products that align with your customers’ habits and needs, you can keep them engaged and interested in your services. This is great for reinforcing their trust and satisfaction with your bank, but it also helps them move to the next stage in the banking sales funnel.

In the consideration stage, analyzing customer behavior is important for better understanding customer patterns and behaviors and offering more personalized banking services.

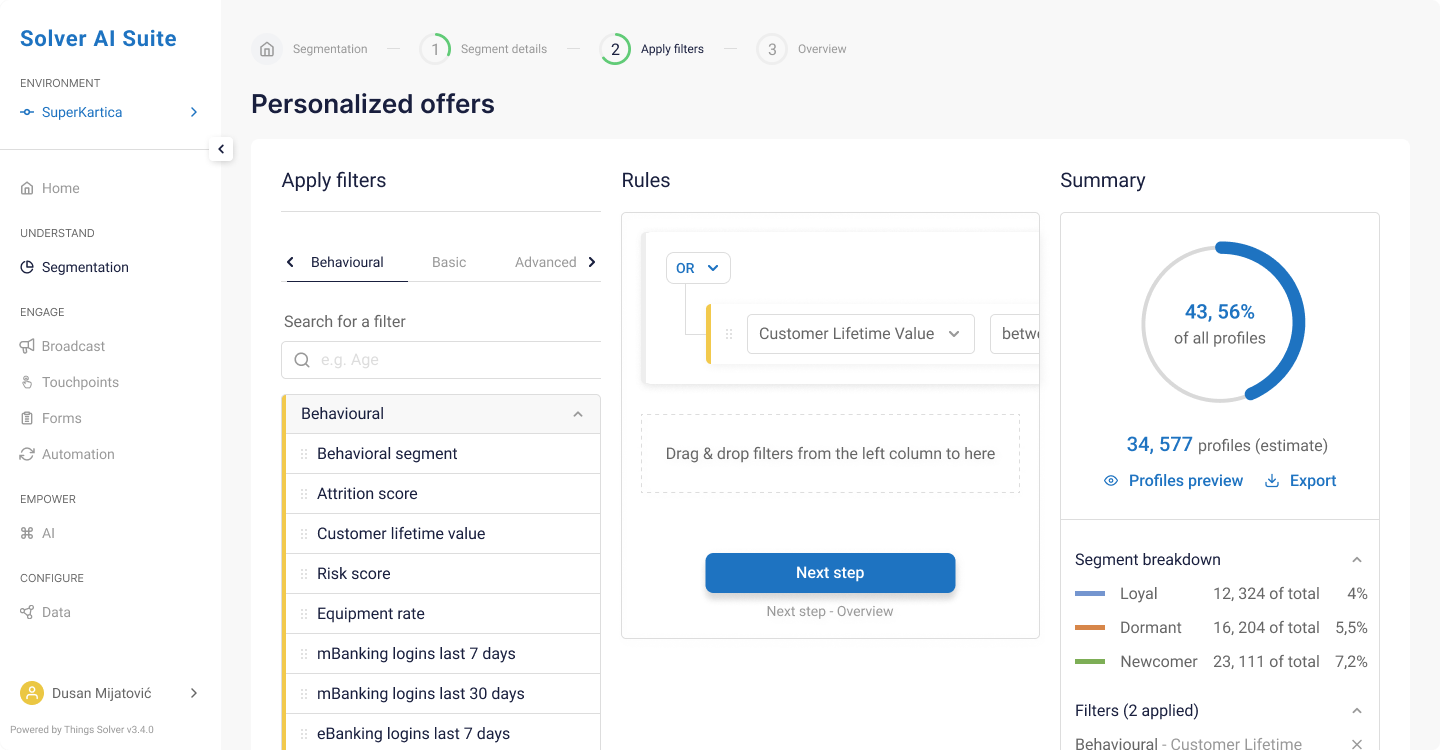

Things Solver’s Solver Segmentation Studio can be particularly effective during this stage. This tool offers AI-powered segmentation and recommendations that provide a 360-degree view of all customer-related data in one place.

The Segmentation Studio allows you to group and centralize your data and combine it with intelligent insights.

Imagine you have a customer who has recently taken out a mortgage and has shown interest in home renovation products through their spending patterns. With Things Solver’s Segmentation Studio, you can analyze this data and suggest relevant financial products, such as a home equity line of credit (HELOC) tailored to their needs.

Moreover, by segmenting customers with similar profiles, you can develop a marketing campaign specifically targeting new homeowners interested in home improvement, offering personalized loan options, competitive interest rates, and flexible repayment plans. This feature is called lookalike audience and it helps you expand your audience according to the most critical characteristics

As you can see, recommenders in banking sales funnel can help you provide a higher level of personalization. They allow you to:

Targeted and meaningful interactions demonstrate your commitment to providing relevant and valuable services to everyone, making it easier for customers to trust you and stay loyal.

During the decision stage, your only goal is to make sure the customer decides to start using or keep using your banking services. To facilitate this process, real-time customized offers play a crucial role. And this is also something recommenders in banking can help you with.

Recommenders are great at analyzing customer behavior in real time to provide instant, tailored offers that address your clients’ last-minute hesitations.

Let’s look at three different examples.

In the first scenario, if a customer is browsing mortgage options on your website, recommenders can instantly offer a reduced interest rate or waive certain fees if they fit a specific timeframe. This approach can nudge the customer towards making a decision more confidently.

Another example could be a customer who often uses their credit card for travel-related expenses. In this case, recommenders in banking sales funnel might detect this pattern and offer them a travel rewards credit card with bonus miles or an upgrade on their existing card with enhanced travel benefits. This real-time suggestion can strengthen your relationship with the client, showing them you understand and support their needs and preferences. You’re giving them a valuable offer just when they need it.

Ultimately, imagine a customer who is applying for a personal loan but hesitates at the final step. Using recommenders, you can offer them a real-time incentive such as a lower interest rate or flexible repayment options to encourage them to complete their application.

The decision stage must be as smooth and appealing as possible for your customers. Additionally, during this stage, your commitment to providing personalized and relevant financial solutions can make or break the relationship with your customer/s.

Finally, in the loyalty stage, your focus should be completely on maintaining the loyalty of your clients and retaining them.

Personalized rewards programs can help you achieve that. If you make use of Things Solver’s tools, you can easily create personalized recommendations for the next financial product or service and ensure that your customers keep feeling appreciated and catered to.

Let’s say you have a customer who is retired and has shown a preference for conservative investment options. Knowing this, you can use Solver Touchpoint Studio to create personalized offers for them, including unique financial planning services or exclusive rates on fixed deposit accounts that align with their risk tolerance and financial goals.

Additionally, the Touchpoint Studio‘s intent-based personalized recommendations enable you to properly segment and present products based on your customers’ intent. This system facilitates upsell and cross-sell opportunities by:

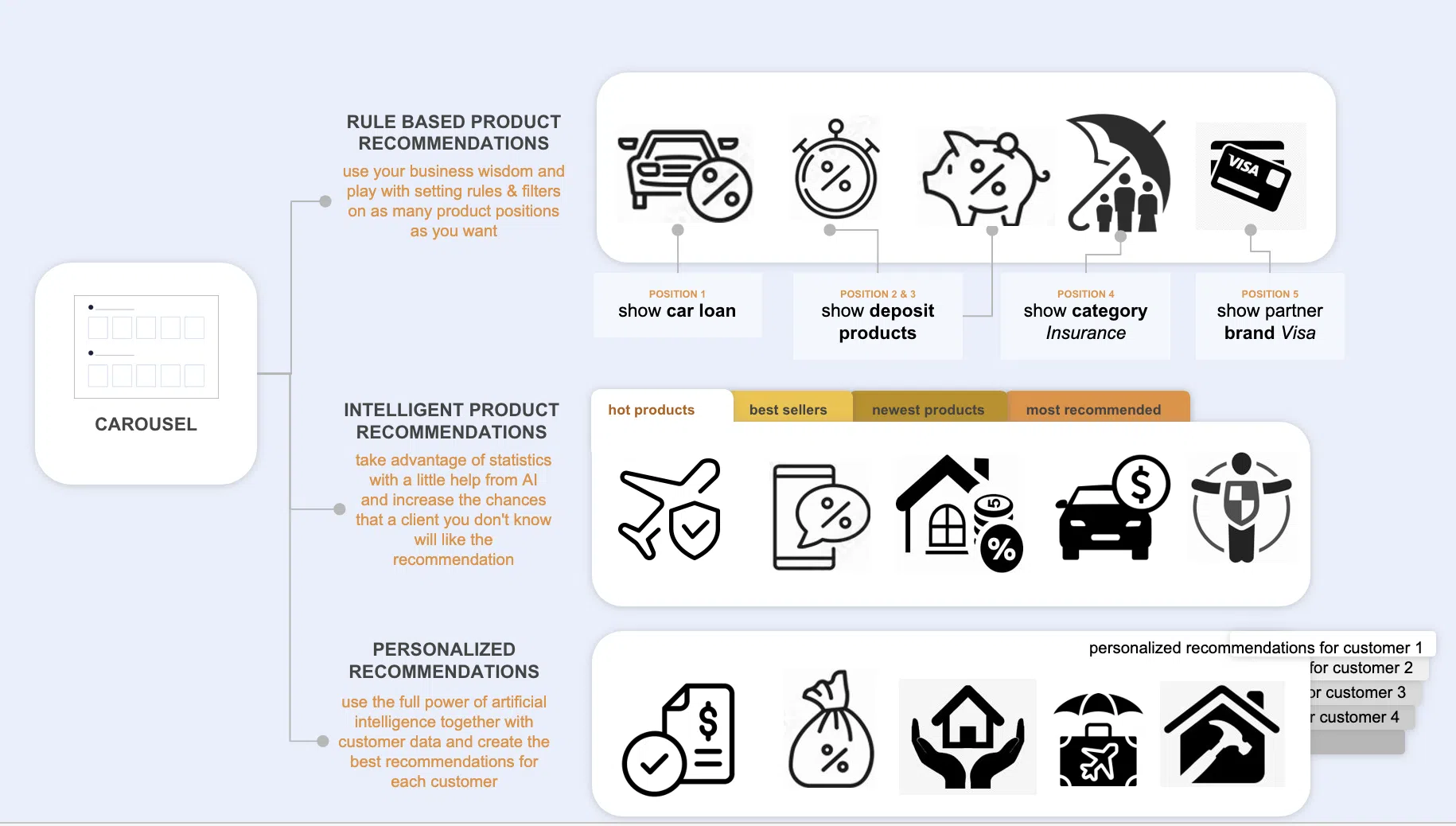

Solver Touchpoint Studio also offers intelligent product recommendations through rule-based and AI-driven suggestions. This approach both serves existing customers with known preferences and uses statistical insights to cater to new customers.

Moreover, the lookalike audience feature can help you further expand the customer base by targeting new individuals with similar characteristics to existing loyal customers.

For example, you can identify a segment of retired customers who regularly use specific banking services. This allows you to target individuals with similar financial habits and needs with tailored promotions for retirement planning tools or special offers on annuity products.

For this phase, or any other for that matter, your goal should be to build a more satisfied and loyal customer base so you can enjoy the success of your business in the long run.

Implementing recommenders in banking sales funnel does have many benefits, but there are also several potential issues that you should be aware of too.

One of the biggest concerns is ensuring the privacy and security of your customers’ data. Dealing with highly sensitive information means that any breach or misuse of data can lead to severe consequences, including losing the trust of your clients and even regulatory penalties.

The financial industry is heavily regulated, so banks have to follow strict rules about how they use and protect customer data. Your job is to make sure that recommenders adhere to these rules, even though it might be tricky and mean changing how you usually do things.

Recommenders in banking sales funnel can accidentally include biases from the data they learn from. If not carefully monitored and managed, they can continue to create these biases, which can lead to unfair treatment of certain customer groups. This can result in negative publicity and potential legal issues.

For recommenders to be effective, they need to provide accurate and relevant suggestions and recommendations. Poor recommendations can frustrate your customers and reduce trust in your bank’s services. Ensuring high-quality data and continually refining algorithms is essential to maintain accuracy.

Implementing a new recommender can mean that you have to integrate it with existing banking infrastructure. This can be technically challenging and may require you to invest significant time and resources to ensure seamless integration and better functionality.

Some customers may be suspicious of the personalized recommendations you offer to them and might perceive them as intrusive or manipulative. That’s why you need to ensure that you’re using recommenders transparently and that customers understand how their data is being used to benefit them.

Developing, implementing, and maintaining advanced recommender systems can put a toll on your bank’s resources. It requires investment in technology, data management, and skilled personnel to manage and optimize them.

Banking products and services can be complex and diverse. Creating a recommender that accurately understands and suggests appropriate financial products requires sophisticated algorithms and a deep understanding of your bank’s unique financial services.

When talking about sensitive financial decisions, you must consider the ethical implications of using recommenders in banking sales funnel. Recommendations you create must be in the best interest of your customers, not just driven by your bank’s profit motives.

Integrating recommenders in your banking sales funnel can completely change how you interact with your customers. They can be your worthy ally and help you offer personalized and timely suggestions, enhance customer satisfaction, build trust, and drive conversions across all stages of the banking sales funnel — from awareness to loyalty.

Despite the potential challenges introducing recommenders can have, you can overcome these with careful planning, continuous monitoring, and investment in robust data management and AI technologies.

As the banking industry continues to evolve, staying ahead of the curve also means partnering with the right people who can help you transform your banking sales funnel and additionally improve your clients’ experiences.

Contact us today to start your journey toward smarter, more personalized banking. Send us an email at ai@thingsolver.com or book a free demo. We’re waiting for you!

The holiday season is the most crucial period for retailers. Besides high sales volume, it is also an opportunity to…

Read moreA closer look at analytics that matter You’ve trained your AI agent. It runs. It talks. It reacts. But does…

Read moreImagine having a team of top chefs, but your fridge is packed with spoiled ingredients. No matter how talented they…

Read more